jefferson parish property tax assessment

Calcasieu Parish Property Records are real estate documents that contain information related to real property in Calcasieu Parish Louisiana. The parish is named for Jefferson Davis president of the Confederate States of America.

Keller Williams Real Estate News Orleans Parish

Justices of the Peace.

. Tammany Parish collects the highest property tax in Louisiana levying an average of 133500 066 of median home value yearly in property taxes while St. You should bring with you a recorded copy of your act of sale for the property and a photo identification showing the address of the property on which the homestead exemption is being filed. Access millions of records ranging from land ownership to tax records 247 from your computer tablet or mobile device.

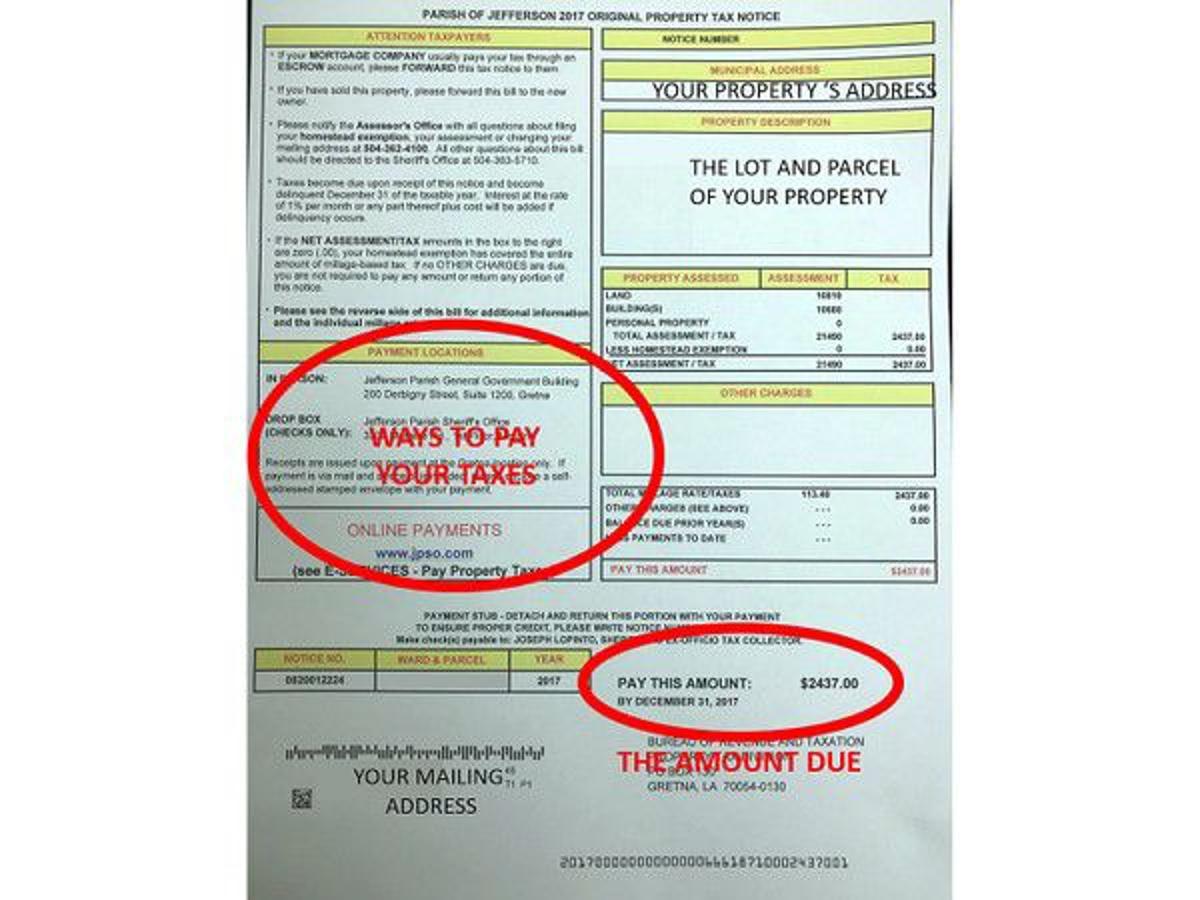

Millages Wards. The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection law enforcement education recreation and other functions of parish government. Landry Parish has the lowest property tax in the state collecting an average tax of 20200 025 of median home value.

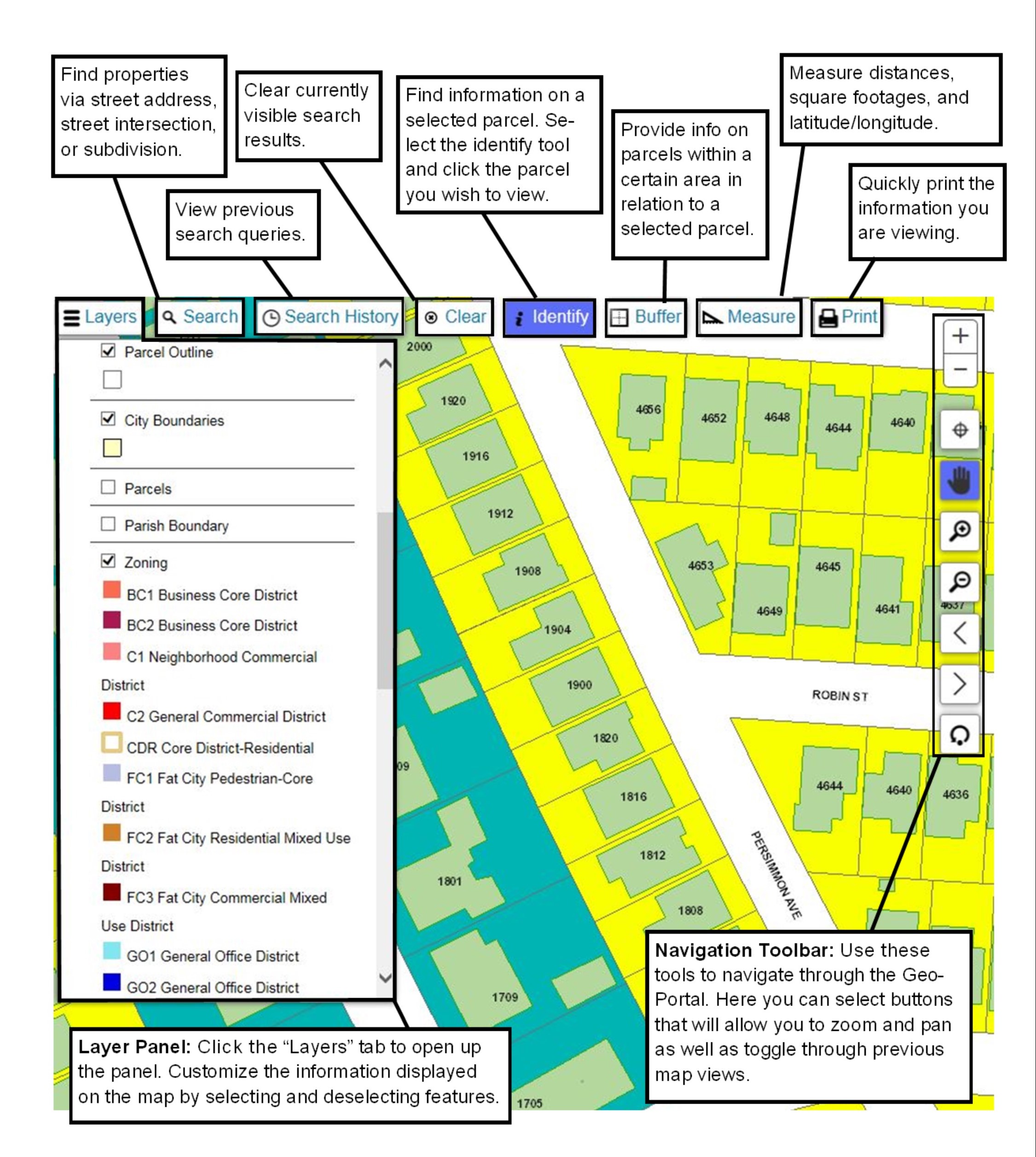

If a husband and wife own the property jointly only one has to appear. Please use the Search feature to find your property of interest. This rate is based on a median home value of 180500 and a median annual tax payment of 940.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. The tax is calculated by multiplying the taxable assessment by the tax rate. Welcome to the Union Parish Assessors Office property assessment records online.

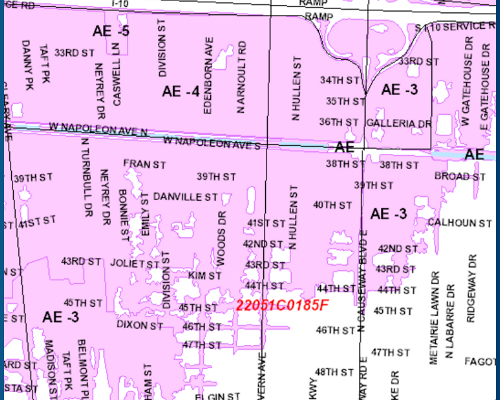

Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a property tax rate of 052. If you have questions or comments please call our office. The exact property tax levied depends on the county in Louisiana the property is located in.

You must appear in person at either location of the Jefferson Parish Assessors office to sign for the homestead exemption. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. The Jefferson Parish Assessors Office determines the taxable assessment of property.

Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes collected. Jefferson Johnson Lafayette. 2016 Jefferson Parish Assessors Office.

318 368-3232 Real Property. Jefferson Davis Parish Profile. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The average effective property tax rate in East Baton Rouge Parish is 061 which is over half the national average.

Reconstruction Grant Kickoff Meeting

Kean Miller Wins Major Property Tax Case At Louisiana Supreme Court Louisiana Law Blog

St Tammany Parish Property Tax Consultant St Tammany

Jp Sheriff S Office Jeffparishso Twitter

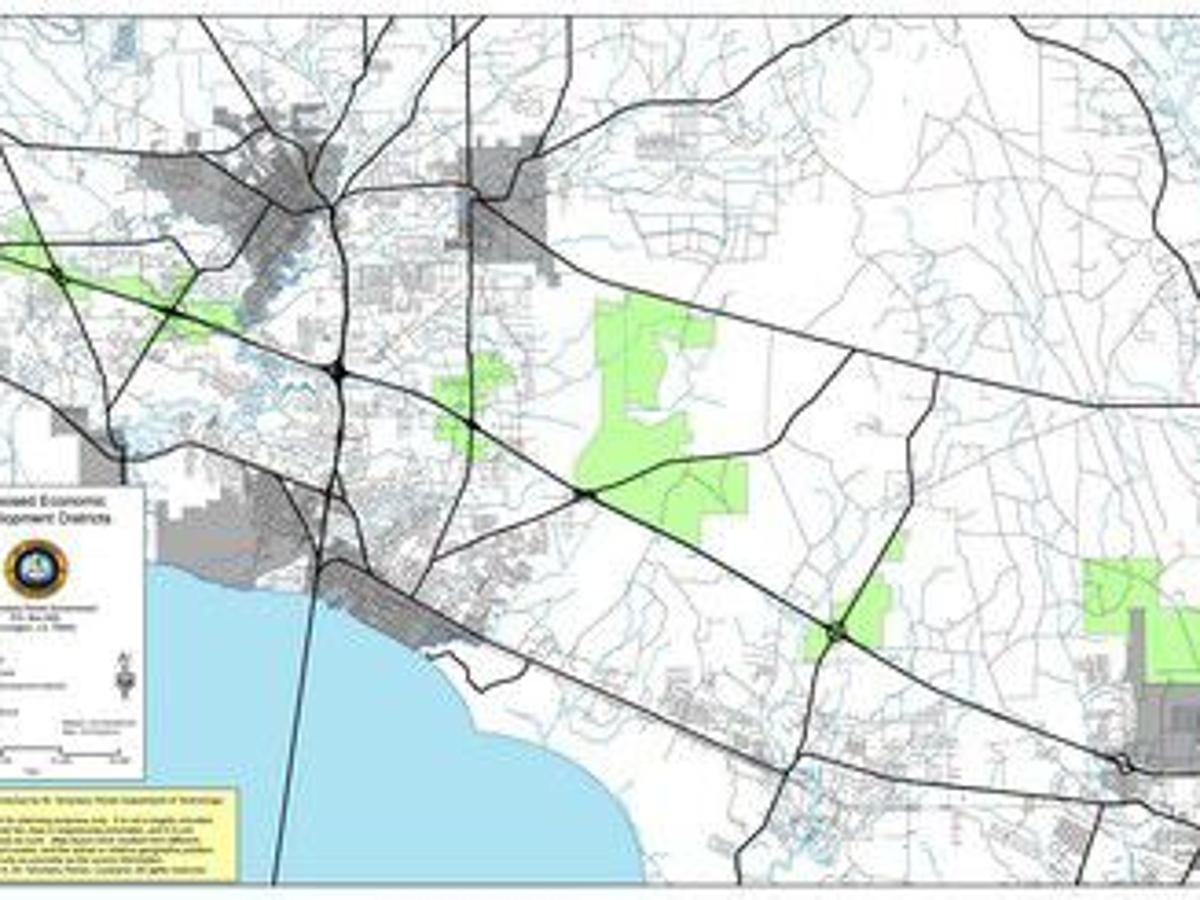

Public Hearing On St Tammany Parish Economic Development Districts Is March 5 Local Politics Nola Com

Jefferson Parish Property Tax Bills Are In The Mail Local Politics Nola Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

E Services Jefferson Parish Sheriff La Official Website

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Someday I Want A House Like This On A Much Smaller Scale With Lots Of Trees Around It And A Few Acres Traditional Exterior Interior Photography Porch Design